Ever heard someone say, “I’ve got this brilliant idea that’s going to disrupt the entire industry!” only to watch their startup crash and burn six months later? Yeah, we’ve all been there—either witnessing it or (let’s be honest) living through it ourselves. The culprit behind many of these startup flameouts? Skipping proper market research.

Look, I get it. When you’re running on bootstrap funding and instant ramen, “market research” sounds like something only corporations with fancy offices and unlimited coffee budgets can afford. The term conjures images of focus groups in sterile rooms, expensive consultants, and reports that cost more than your monthly runway.

But here’s the reality check you need: market research isn’t just for the big players with deep pockets. It’s the difference between building something people actually want and shouting into the void while burning through your savings.

The good news? You don’t need to drop thousands of dollars or delay your launch by months to gather meaningful insights. The even better news? We’re about to show you budget friendly (and sometimes completely free) ways to conduct effective market research that will dramatically increase your chances of success.

Think about it this way: would you rather spend a few days and minimal resources understanding your market now, or waste months and your entire budget building something nobody wants? When you put it like that, the choice becomes pretty obvious.

In this guide, you’ll discover:

- How to leverage free tools and platforms you’re already using for valuable market insights

- Simple techniques to understand your competitors without expensive software

- Ways to get direct feedback from potential customers without hiring a research firm

- AI-powered shortcuts that give you professional-level insights on a startup budget

- Real examples of startups that used these exact methods to validate their ideas before investing heavily

By the end of this article, you’ll have a practical toolkit of market research methods that fit your budget constraints while still delivering the critical insights you need to make informed decisions. Because smart founders know that guesswork is expensive—but research doesn’t have to be.

Cheap Market Research Methods That Actually Work

Ever felt like quality market research is only for companies with deep pockets? Think again. These affordable methods deliver real insights without breaking the bank.

1. Online Surveys and Questionnaires

What it is: A structured way to collect feedback directly from your target audience using digital forms.

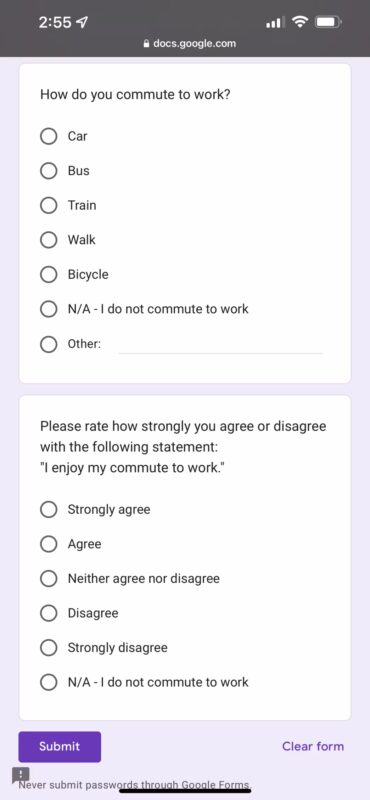

How to implement it: Start with free tools like Google Forms or SurveyMonkey’s basic tier. Keep surveys short (5-7 questions) and focused on a single topic. Distribute through email lists, social media, or embed on your website.

Benefits and limitations: Online surveys provide quantifiable data quickly and at scale. However, response rates can be low, and without careful design, questions may yield biased or superficial answers.

Pro tip: Offer a small incentive like a discount code or entry into a prize drawing to boost response rates.

2. Social Media Listening

What it is: Systematically monitoring social platforms for mentions of your brand, competitors, or industry keywords.

How to implement it: Set up free alerts using Google Alerts or TweetDeck. Create lists of competitors and industry influencers on platforms like Twitter and LinkedIn. Join relevant Facebook and LinkedIn groups where your target customers gather.

Benefits and limitations: Social listening provides real-time, unfiltered customer opinions and competitive intelligence. The downside? It can be time-consuming to filter signal from noise, and the data isn’t always representative of your entire market.

3. Competitor Analysis

What it is: A systematic examination of your competitors’ products, pricing, marketing strategies, and customer feedback.

How to implement it: Create a simple spreadsheet to track competitor features, pricing, messaging, and customer reviews. Use tools like SimilarWeb’s free tier to analyze competitor website traffic. Sign up for competitor newsletters and follow their social accounts.

Benefits and limitations: Competitor analysis helps identify market gaps and avoid reinventing the wheel. However, focusing too much on competitors can limit innovation and lead to “me-too” products.

4. Customer Interviews

What it is: One-on-one conversations with current or potential customers to gather in-depth insights about their needs, pain points, and preferences.

How to implement it: Identify 5-10 people from your target audience. Prepare a discussion guide with open-ended questions. Conduct 30-minute interviews via free tools like Zoom or Google Meet. Record (with permission) and take notes.

Benefits and limitations: Interviews provide rich, contextual data and unexpected insights that surveys might miss. The main limitations are small sample sizes and the time investment required.

5. Landing Page Testing

What it is: Creating a simple webpage that describes your product concept to gauge market interest before building anything.

How to implement it: Use affordable tools like Carrd ($19/year) or Unbounce (starting at $80/month) to create a professional landing page. Include a clear value proposition and call-to-action (like “Join waitlist” or “Get early access”). Drive traffic using social media or minimal ad spend ($50-100).

Benefits and limitations: Landing page tests provide concrete evidence of market interest through sign-up rates. The challenge is driving enough relevant traffic to make the data meaningful.

6. Keyword Research

What it is: Analyzing what terms people search for related to your product or industry.

How to implement it: Use free tools like Google Keyword Planner, Ubersuggest, or AnswerThePublic to discover search volumes and related queries. Look for terms with decent search volume but lower competition.

Benefits and limitations: Keyword research reveals actual customer language and priorities, helping you align messaging with market demand. However, search data alone doesn’t explain the “why” behind customer behavior.

7. Leveraging Public Data

What it is: Using freely available government statistics, academic research, and industry reports to understand market trends.

How to implement it: Explore resources like the U.S. Census Bureau, Bureau of Labor Statistics, or industry-specific government databases. University libraries often provide public access to research databases. Google Scholar offers free access to academic papers.

Benefits and limitations: Public data provides objective, large-scale information that would be impossible to collect yourself. The downside is that the data may not be recent enough or specific to your exact market segment.

Combining Methods for Maximum Impact

No single research method gives you the complete picture. For best results, combine quantitative methods (surveys, keyword research) with qualitative approaches (interviews, social listening).

For example, use keyword research to identify topics, create a survey to quantify preferences, then conduct interviews to understand the “why” behind the numbers.

Remember, even imperfect research is better than none. Start small, be consistent, and let the insights guide your business decisions. Your wallet—and your future customers—will thank you.

Key Takeaway: The most effective market research doesn’t have to be expensive. Focus on methods that offer high impact with minimal investment for your startup’s specific needs.

Selecting the Right Market Research Methods: A Decision Framework

Why Method Selection Matters

Choosing the right market research method is like selecting the right tool for a home improvement project—using a hammer when you need a screwdriver wastes time and leaves you with poor results. With different market research approaches available (many at low or no cost), the challenge isn’t finding methods—it’s selecting the ones that will deliver actionable insights within your constraints.

As a startup founder or entrepreneur, your resources are precious. The right market research approach maximizes your return on investment, whether that investment is time, money, or both. Poor method selection, on the other hand, can lead to misleading data, wasted resources, or analysis paralysis.

Key Decision Factors for Method Selection

Before diving into specific methods, consider these five critical factors that should guide your market research choices:

1. Budget Constraints

Your available budget dramatically impacts which methods make sense:

- Free methods: Social media listening, competitor website analysis, and customer interviews can deliver valuable insights without spending a dime.

- Low-cost methods: Online surveys, Reddit/forum analysis, and Google Trends require minimal investment ($50-500) but offer structured data collection.

- Medium-cost methods: Consider these only when validation is critical and the cost of being wrong exceeds the research investment.

2. Time Availability

The timeline for your decision should dictate your approach:

- Quick-turn methods (Low time requirement): Social listening, secondary research, and competitor analysis can deliver insights in hours or days.

- Medium-term methods: Customer interviews, online surveys, and usability testing typically require 1-3 weeks for meaningful results.

- In-depth methods: Longitudinal studies and comprehensive market analysis require months but provide deeper insights.

3. Data Quality Requirements

Consider what type of data will best answer your questions:

- Qualitative insights: When you need to understand “why” and “how,” methods like interviews and focus groups excel.

- Quantitative validation: When you need to know “how many” or “how much,” surveys and analytics data provide statistical confidence.

- Mixed-method approach: Often the most powerful, combining qualitative discovery with quantitative validation.

4. Target Audience Accessibility

Your ability to reach your audience affects method viability:

- Easily accessible audiences: B2C consumer products can leverage social media and online surveys effectively.

- Niche or professional audiences: B2B solutions may require industry events, LinkedIn outreach, or specialized panel recruitment.

- Hard-to-reach demographics: Some groups require creative approaches like community partnerships or incentivized referrals.

5. Business Stage and Goals

Your company’s maturity and immediate objectives matter:

- Pre-launch validation: Focus on problem validation and willingness to pay.

- Early-stage feedback: Prioritize user experience and product-market fit research.

- Growth-stage optimization: Emphasize competitive analysis and customer satisfaction measurement.

The Market Research Method Selection Matrix

To simplify your decision process, use this framework to match your situation to the right methods:

| If you need… | And your constraints are… | Consider these methods… |

|---|---|---|

| Problem validation | Low budget, quick timeline | Customer interviews, Social listening, Online forums |

| Solution validation | Low budget, medium timeline | Surveys, Landing page tests, Competitor analysis |

| Market sizing | Low-medium budget, medium timeline | Secondary research, Industry reports, Google Trends |

| User experience insights | Low budget, quick-medium timeline | Usability testing, Session recordings, Customer interviews |

| Competitive intelligence | Low budget, ongoing | Social media monitoring, Website analysis, Product comparisons |

Recommended Method Combinations for Common Scenarios

Different business situations call for different research approaches. Here are tailored combinations for common scenarios:

Scenario 1: Early-Stage B2C Startup with Limited Budget

When you’re just starting with a consumer product and have minimal resources:

- Create detailed customer profiles to clarify who you’re targeting

- Use one-question email surveys for specific feedback points

- Analyze competitors’ marketing materials to understand positioning

- Research your unique strengths to differentiate effectively

This combination costs virtually nothing but provides a 360° view of your market opportunity.

Scenario 2: B2B SaaS Startup Validating Product-Market Fit

For software companies targeting business customers:

- Conduct problem interviews with 15-20 potential customers

- Analyze competitor pricing and features to identify gaps

- Test landing page messaging with different value propositions

- Use LinkedIn for targeted outreach to ideal customer profiles

This approach validates both the problem and your proposed solution before significant development investment.

Scenario 3: E-commerce Expanding Product Lines

When adding new products to an existing online store:

- Analyze search trends to identify seasonal patterns

- Survey existing customers about complementary needs

- Run small-batch inventory tests before major investment

- Monitor social media sentiment around similar products

This combination reduces inventory risk while leveraging your existing customer base.

Common Method Selection Pitfalls to Avoid

Even experienced researchers make these mistakes when choosing market research approaches:

- Confirmation bias selection: Choosing only methods likely to validate your existing beliefs

- Overreliance on a single method: Using only surveys or only interviews, missing the complete picture

- Mismatched method to question: Using quantitative methods for exploratory questions or vice versa

- Analysis paralysis: Collecting too much data without actionable frameworks

- Skipping competitive research: Focusing only on customers while ignoring market context

Making the Final Decision: Your Action Plan

To select the right market research methods for your specific situation:

- Define your research questions with extreme clarity

- Assess your constraints honestly (budget, time, team capabilities)

- Choose a primary method that best addresses your core question

- Complement with 1-2 supporting methods for validation

- Start small and iterate rather than planning massive research initiatives

Remember that imperfect research executed quickly often provides more value than perfect research delivered too late. The best approach is one you can actually implement with the resources you have available.

For a deeper dive into research question formulation, check out our guide to asking better research questions or explore Harvard Business Review’s article on knowing what your customers want.

Key Takeaway: Selecting the right market research method is about matching your specific business questions with the appropriate research approach while considering your time, budget, and expertise constraints.

Leveraging ChatGPT for Budget-Friendly Market Research

ChatGPT has emerged as a game-changing tool for market research. Think of it as your always-available research assistant that doesn’t charge by the hour. Let’s explore how you can harness this AI powerhouse to gather insights without breaking the bank.

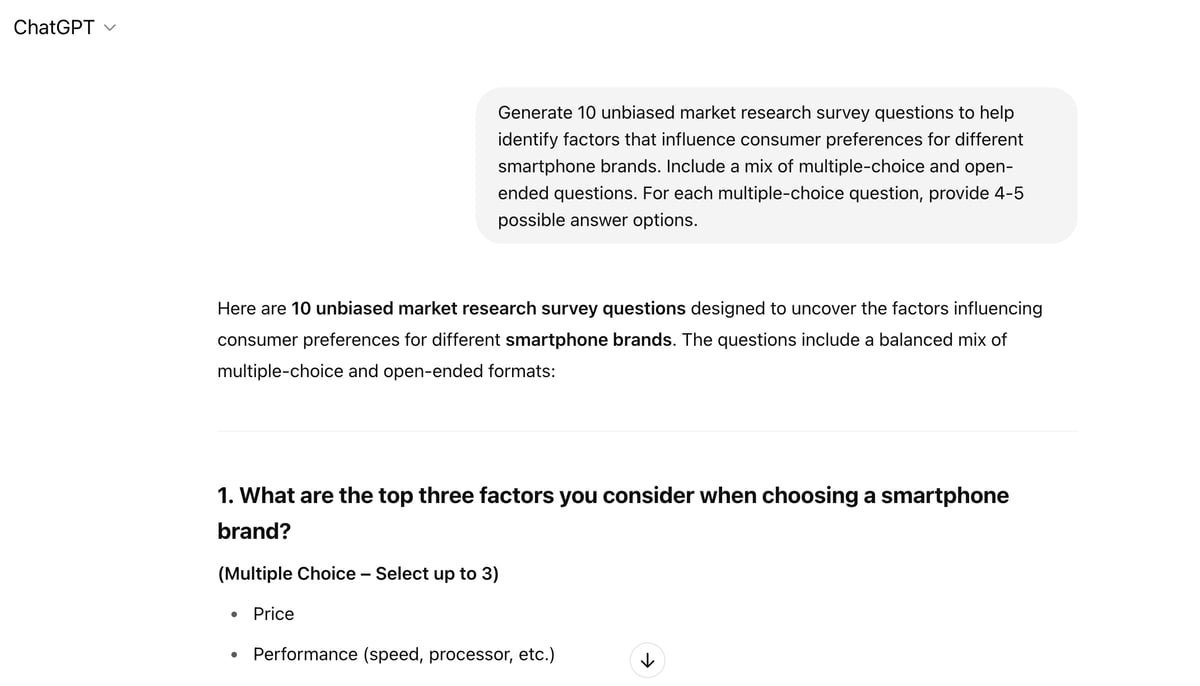

Creating Effective Survey Questions

Struggling to design survey questions that yield reliable, actionable market research data? ChatGPT can assist you in generating insightful, well-constructed questions that help you truly understand your target market.

How to use ChatGPT for survey creation:

- Define your research objective (e.g., “I want to identify factors that influence consumer preference for different smartphone brands”)

- Ask ChatGPT to generate questions targeting various dimensions of your research topic

- Request variations tailored to different demographic or psychographic segments

- Have ChatGPT review your existing questions to eliminate bias or leading language

Example prompt:

Generate 10 unbiased market research survey questions to help identify factors that influence consumer preferences for different smartphone brands. Include a mix of multiple-choice and open-ended questions. For each multiple-choice question, provide 4-5 possible answer options.

This approach saves hours of brainstorming and helps you avoid common survey design pitfalls that can skew your results.

Developing Customer Personas

Customer personas don’t have to be built from scratch. ChatGPT can help you create detailed, realistic personas based on market segments you’re targeting.

Step-by-step guide to creating personas with ChatGPT:

- Provide ChatGPT with basic information about your target market

- Ask it to generate 3-5 distinct personas with demographic details

- Request elaboration on pain points, goals, and behaviors for each persona

- Use these personas to refine your follow-up questions

Example prompt:

I’m launching a mobile app that helps people track and reduce their carbon footprint. Create 3 detailed customer personas for my potential users. For each persona, include: name, age, occupation, income level, education, goals, pain points, typical day, tech comfort level, and environmental concerns. Make these personas realistic and diverse.

The resulting personas give you a foundation to build upon with real customer data as you collect it.

Conducting Competitive Analysis

Analyzing competitors doesn’t require expensive market research tools. ChatGPT can help you structure your analysis and identify key areas to investigate.

- Use it to create comprehensive competitor analysis frameworks

- Generate lists of features to compare across competitors

- Identify potential market gaps based on competitor offerings

- Draft hypotheses about competitor strategies

Example prompt:

Create a detailed competitive analysis framework for a new meal kit delivery service. Include categories for pricing structure, target audience, menu variety, sourcing practices, packaging, delivery options, and marketing approaches. Then suggest specific metrics to track for each category.

While ChatGPT won’t have real-time data about your specific competitors, it provides the structure you need to conduct thorough research efficiently.

Analyzing Customer Feedback

Sitting on a mountain of customer reviews, survey responses, or support tickets? ChatGPT excels at helping you make sense of qualitative data.

Step-by-step guide to feedback analysis with ChatGPT:

- Organize your feedback data in a spreadsheet or document

- Share representative samples with ChatGPT (10-15 examples)

- Ask it to identify common themes, sentiment, and priority issues

- Request suggestions for follow-up questions to clarify findings

Example prompt:

Here are 12 customer reviews from our software product. Please analyze them to identify: 1) Common pain points, 2) Features customers love, 3) Suggested improvements mentioned multiple times, 4) Overall sentiment, and 5) Any emerging trends I should pay attention to.

[Paste your reviews here]

This approach helps you quickly identify patterns that might take hours to spot manually.

Limitations and Best Practices

ChatGPT is powerful, but it’s not perfect. Keep these limitations in mind:

- Not a replacement for real customer data – Use it to supplement, not substitute

- Potential for outdated information – Verify market trends with current sources

- No access to proprietary competitor data – You’ll still need to gather this yourself

- May reflect biases in its training data – Always review outputs critically

For best results:

- Be specific in your prompts

- Provide context about your industry and target market

- Use ChatGPT early in your research process to structure your approach

- Validate AI-generated insights with real customer data when possible

- Combine ChatGPT with other research methods for a complete picture

When to Use ChatGPT vs. Other Research Methods

ChatGPT works best for:

- Initial research planning

- Generating hypotheses to test

- Structuring qualitative data analysis

- Creating frameworks for deeper research

- Brainstorming questions and approaches

It’s less effective for:

- Real-time market data

- Statistically valid sampling

- Industry-specific compliance requirements

- Highly technical or specialized domains without additional context

By strategically incorporating ChatGPT into your market research toolkit, you can dramatically reduce the time and cost of gathering insights. Just remember that it’s most powerful when used to enhance your research process, not replace critical thinking and direct customer engagement.

Key Takeaway: AI tools like ChatGPT can dramatically reduce the cost and time investment of market research while maintaining quality insights when used strategically.

Common Pitfalls in DIY Market Research: Don’t Let Your Data Lead You Astray

You’ve learned about various affordable market research methods and how AI tools like ChatGPT can help. But before you rush off to survey everyone in sight, let’s talk about the elephant in the room: bad data can be worse than no data at all.

According to a 2023 Gartner report, 60% of business decisions based on flawed market research led to strategy adjustments within six months. As the saying goes, “Garbage in, garbage out” – and on a tight budget, you can’t afford to make decisions based on garbage.

The Usual Suspects: Common Market Research Mistakes

1. Confirmation Bias: Finding What You Want to Find

We all love being right. In market research, this leads to confirmation bias – where you unconsciously seek out information that confirms your existing beliefs.

Real-world example: A startup founder was convinced millennials would love his new productivity app. His surveys seemed to confirm this – until we realized he was only sharing his concept with tech-forward friends. When we expanded to a more representative sample, the feedback was dramatically different.

How to avoid it:

- Actively seek out contradictory opinions

- Have someone else review your research questions

- Be willing to hear “no” – sometimes the most valuable feedback is negative

2. Sample Size Theater: When “Not Enough” Meets “Too Many”

“We surveyed 10 people and 8 loved our product!” sounds impressive until you realize that’s an 80% confidence level with a massive margin of error. Conversely, thousands of responses from the wrong audience are equally useless.

How to avoid it:

- For qualitative research, aim for 5-8 participants per user segment

- For quantitative research, target at least 100 responses

- Focus on quality over quantity – 50 responses from your target market beat 500 from random internet users

3. Leading Questions: When Your Survey Becomes a Sales Pitch

“Don’t you agree that our amazing product solves your biggest problem?” is not a research question – it’s a leading question that begs for a positive response.

How to avoid it:

- Use neutral language: “How would you describe your experience with our product?”

- Ask open-ended questions that don’t suggest a “right” answer

- Include a mix of positive and negative options in multiple-choice questions

4. Misinterpreting Data: When Numbers Tell the Wrong Story

Data without context is just numbers. Misinterpreting research happens when you lack the analytical framework to understand what the data actually means.

Real-world example: An e-commerce company saw that 70% of visitors abandoned their cart at the payment page. They assumed pricing was the issue and offered discounts without improving conversion. Later analysis revealed the real problem was a confusing checkout process.

How to avoid it:

- Look for patterns across multiple data sources

- Consider alternative explanations for your findings

- Use qualitative research to explain the “why” behind quantitative data

5. Over-reliance on Free Tools

Free tools are fantastic, but they have limitations. Relying exclusively on free versions can lead to incomplete data and flawed conclusions.

How to avoid it:

- Understand what you’re missing in free versions

- Combine multiple free tools to fill in gaps

- Consider investing in one paid tool rather than using five limited free ones

Ensuring Data Quality When Your Budget Is Tight

Quality market research doesn’t have to break the bank. Here’s how to maintain data integrity without spending a fortune:

- Triangulate your findings: Use at least three different research methods to verify important insights.

- Implement quality checks: For surveys, include attention-check questions. For interviews, have a consistent discussion guide.

- Focus on representative samples: A smaller, well-targeted sample beats a larger, random one.

- Document your methodology: Keep detailed records of how you conducted your research.

The most common mistake in DIY market research isn’t using cheap tools – it’s failing to recognize their limitations.

Jacek Głodek

When to Call in the Professionals

DIY market research is powerful, but sometimes you need experts. Here are signals it’s time to invest in professional help:

- When the stakes are extremely high: If you’re making a bet-the-company decision, professional research provides an extra layer of confidence.

- When you need specialized expertise: Some research requires technical knowledge, like conjoint analysis for pricing.

- When you need truly unbiased feedback: If you’re too close to your product, an outside researcher can gather feedback without emotional attachment.

The good news? You don’t have to go all-in on expensive research firms:

- Hire a freelance research consultant for specific projects

- Partner with a local university’s business school for student-led research

- Invest in one professional report annually, supplemented with DIY efforts

Turning Pitfalls into Stepping Stones

Market research mistakes happen to everyone. The difference is in how you respond:

- Document lessons learned from each research project

- Build a research playbook that evolves over time

- Share findings transparently, including limitations

Remember, perfect research doesn’t exist – but research that’s good enough to inform better decisions definitely does. By avoiding these common pitfalls, you’ll get maximum value from your market research efforts, regardless of your budget.

In the next section, we’ll wrap everything up with an action plan for effective, affordable market research.

Key Takeaway: Being aware of common market research pitfalls allows you to design more effective research processes and avoid costly mistakes that could lead your startup in the wrong direction.

The Bottom Line: Taking Action on Your Market Research

Market research doesn’t have to break the bank or consume months of your time. As we’ve explored throughout this guide, there are numerous affordable and accessible methods that can deliver powerful insights to drive your business forward.

From free options like social media listening and competitor analysis to low-cost investments in customer interviews and AI-powered research tools like ChatGPT, you now have a toolkit of approaches that fit any budget. The key is not to view these methods in isolation, but to strategically combine them based on your specific business questions and stage of development.

Remember that even the simplest research efforts can help you avoid costly mistakes. A few hours spent analyzing online communities or conducting keyword research can reveal customer pain points and market gaps that might otherwise remain hidden. The ROI of proper market research is undeniable — it reduces risk, accelerates decision-making, and increases your chances of building products people actually want.

Where to Start Today

Begin by selecting 2-3 methods from this guide that align with your most pressing business questions:

- Need to understand your target audience better? Start with social media listening and online surveys.

- Wondering how you stack up against competitors? Implement DIY benchmarking and competitor analysis.

- Testing a new product concept? Try landing page testing and community-based research.

The most successful startups don’t view market research as a one-time activity but as an ongoing practice that informs every business decision.

When DIY Isn’t Enough

While these DIY methods provide excellent starting points, there are situations where professional guidance can dramatically accelerate your progress. If you’re facing complex market questions or need to make high-stakes decisions, consider investing in expert support.

At Iterators, we help startups and established businesses transform market insights into actionable product strategies. Our discovery workshops combine technical expertise with market research methodologies to identify the most valuable opportunities for your business.

Ready to take your market research to the next level? Schedule a free consultation to discuss how our team can help you translate market insights into a winning product roadmap.