Picture this: You’re sitting in a bar with your co-founder, nursing a whiskey, when they hit you with the idea that changes everything—”What if we could use blockchain to sell a $10 million building the same way people trade Pokemon cards?”

You’d probably laugh. Or order another drink. But here’s the thing: blockchain technology is making exactly that scenario possible in real estate right now.

And if you’re not paying attention, you’re about to miss the biggest infrastructure play since the internet itself.

The global real estate market is worth over $379 trillion according to Savills Global Real Estate. That’s trillion with a T. It’s the world’s largest asset class, and it’s been running on the same creaky infrastructure since your great-grandfather bought his first property with a handshake and a paper deed.

Now? We’re watching that entire system get rebuilt from the ground up using blockchain technology. And no, this isn’t about buying penthouses with Bitcoin—that ship sailed years ago. This is about something far more fundamental: turning buildings into programmable assets that trade like stocks.

Ready to build the infrastructure that powers the next generation of real estate? Schedule a free consultation with our blockchain development team and let’s discuss how to turn your vision into a scalable, compliant platform.

The Real Problem Blockchain Solves (Hint: It’s Not What You Think)

Let’s get something straight right away. Blockchain in real estate isn’t about being trendy or slapping “crypto” on your pitch deck to impress VCs. It’s about solving a very specific, very expensive problem that’s been bleeding the industry dry for decades.

That problem? The illiquidity discount.

Traditional real estate transactions are a nightmare of friction:

- Transaction costs running 6-10% of the property value

- Settlement times stretching 30-60 days

- Zero transparency in title provenance

- Minimum investments that lock out 99% of potential investors

These inefficiencies effectively trap trillions of dollars in value. You can’t sell half your apartment when you need cash. You can’t buy $100 worth of a commercial building in Manhattan. And if you want to invest in international real estate? Good luck navigating the legal maze without spending more on lawyers than you make in returns.

Blockchain doesn’t just improve this system—it fundamentally rewrites it.

By 2035, the tokenized real estate market is projected to hit $4 trillion, representing a compound annual growth rate of 27%. That’s not hype—that’s the sound of locked capital finally finding liquidity.

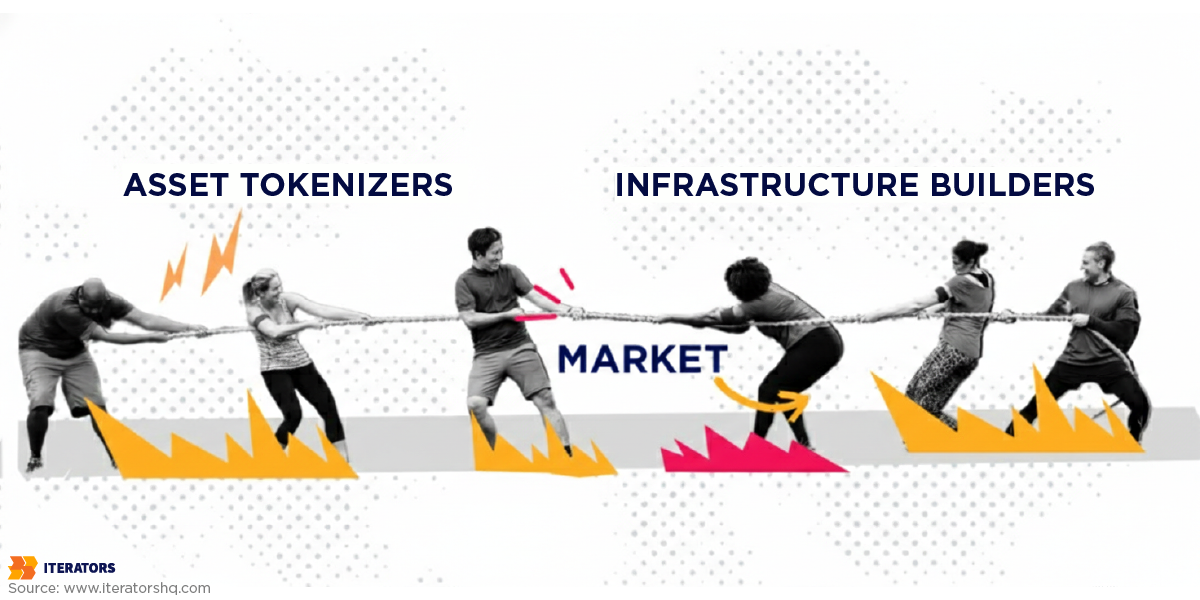

The “Cheese and Crackers” Framework: Where Blockchain Real Estate Money Is

Here’s where most founders get it wrong.

They see blockchain real estate and immediately think: “I’ll tokenize properties and sell equity!” They’re focused on the asset—the “Cheese,” if you will.

But the market is already drowning in Cheese. Every developer and their cousin wants to sell equity in their building.

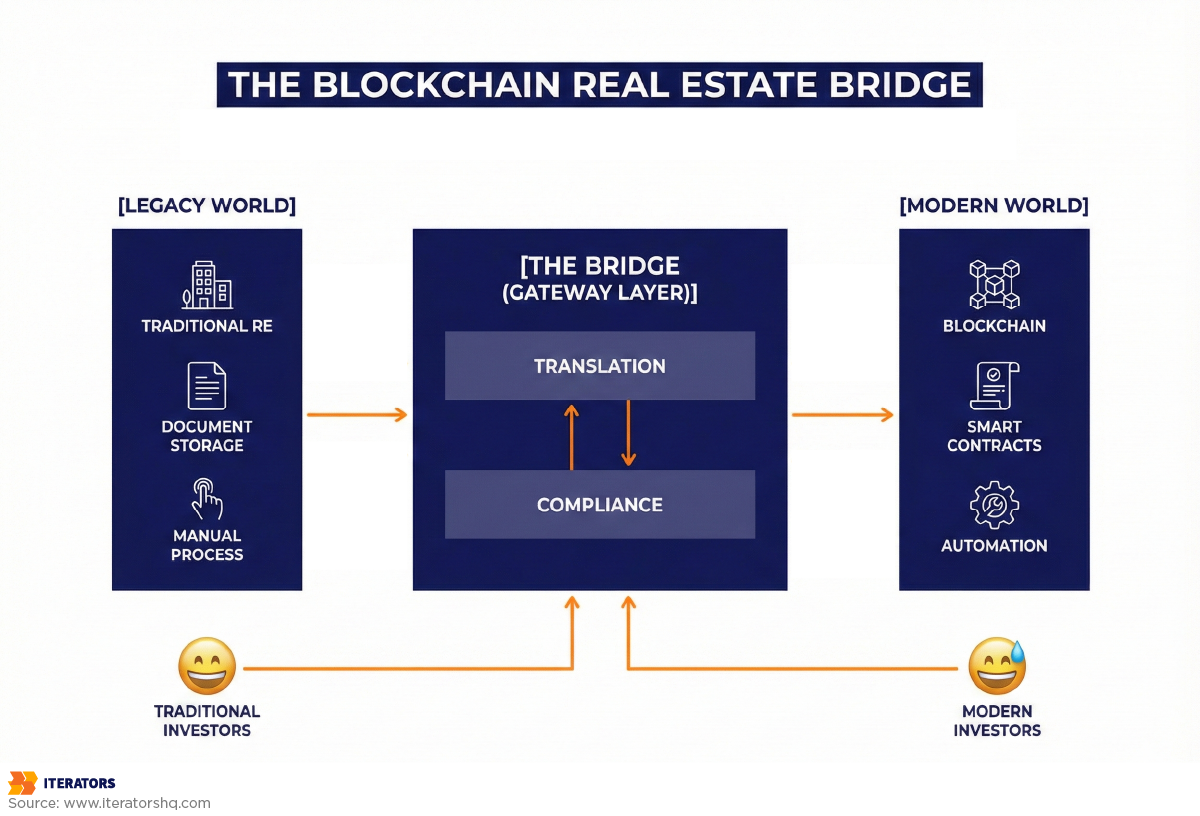

What’s missing? The “Crackers”—the enterprise-grade infrastructure that makes all of this actually work.

Think about it. Who makes more money: the gold miners or the people selling shovels to gold miners?

The most durable value in this space lies in building the platforms that support high-value asset trading:

- Exchange engines that handle complex compliance workflows

- Automated dividend distribution systems that work across borders

- Mobile interfaces that make blockchain invisible to end users

- Backend systems robust enough to handle thousands of concurrent transactions

This is where companies like Iterators come in. While everyone else is fighting over which building to tokenize, we’re building the rails that make the entire ecosystem possible.

Why 2025 Is The Inflection Point (And Why You Need To Move Now)

You might be thinking: “Blockchain has been ‘the future’ for years. Why should I believe it’s different now?”

Fair question. Here’s why 2025 is fundamentally different from 2018’s crypto hype cycle:

1. Regulatory Clarity Finally Exists

The wild west days are over. Europe’s MiCA (Markets in Crypto-Assets) regulation has created a unified licensing regime across the EU. Get licensed in one member state, and you can operate in all 27 countries. Compare that to the US, where you might need money transmitter licenses in 50 separate states plus federal SEC compliance.

The SEC has also evolved its guidance on tokenized securities. The rules are clear now. You can actually build a compliant business instead of playing regulatory roulette.

2. Blockchain Technology Has Stabilized

Remember when gas fees on Ethereum cost more than the transaction itself? Those days are gone.

Layer 2 solutions like Polygon now offer:

- 65,000 transactions per second (vs. Ethereum’s 15)

- Negligible transaction costs (pennies instead of dollars)

- The same security as Ethereum’s main chain

This makes the unit economics of tokenization actually viable. You can now distribute daily dividends to thousands of token holders without spending more on gas fees than you’re distributing.

3. Institutions Are Moving From Pilots to Production

This is the big one. 12% of global real estate firms have moved beyond discussion to actual implementation, with another 46% actively piloting solutions.

When BlackRock’s Larry Fink calls tokenization “the next generation for markets,” that’s not speculation—that’s a signal that institutional capital is ready to flow.

The Blockchain Economics: Why This Actually Makes Financial Sense

Let’s talk about cold, hard numbers. Because at the end of the day, blockchain is only interesting if it improves your bottom line.

The Blockchain Liquidity Arbitrage

Traditional real estate is binary: you own it or you don’t. Selling requires months of effort and massive transaction costs.

Tokenization changes the game entirely.

Take a $10 million commercial building. In the traditional model, you need to find someone with $10 million (or convince a bank to lend it). Your buyer pool is tiny.

Now tokenize it into 10 million tokens at $1 each. Suddenly, you can tap into the “long tail” of capital—thousands of retail investors who can’t afford $10 million but can easily invest $100 or $1,000.

This isn’t just democratization. It’s arbitrage.

A developer might pay 12% interest on a mezzanine loan from a private equity fund. But by selling tokenized equity to a global pool of retail investors satisfied with 6-8% yields, that developer significantly lowers their weighted average cost of capital.

Having worked extensively in fintech development, we understand how blockchain can fundamentally reshape capital structures and reduce funding costs.

That’s real money saved. That’s a competitive advantage.

Blockchain’s Hidden Cost Savings

But wait, there’s more. (Yes, I went to a full infomercial there.)

Consider the administrative burden of managing a real estate syndicate with 500 investors. In the traditional model:

- Manual dividend calculations

- Individual bank wires or checks

- Quarterly investor reports

- Constant phone calls from investors asking “where’s my money?”

This administrative overhead effectively caps how many investors you can handle.

With blockchain? A smart contract automatically:

- Reads the rental income deposit

- Calculates pro-rata shares for each token holder

- Distributes funds (in stablecoins) instantly

- Generates transparent, on-chain records

This process costs pennies in network fees and requires zero human intervention. Studies show this can reduce operational overhead by up to 40%.

Suddenly, having 10,000 investors isn’t a nightmare—it’s just a number in a database.

Smart Contracts: Not As Smart As You Think (And That’s Okay)

Let’s address the elephant in the room: smart contracts.

The name is misleading. They’re not particularly “smart,” and they’re definitely not “contracts” in the legal sense.

Think of them as automated vending machines. You put in the right inputs (money, verification), and you get the right outputs (ownership token, dividend payment). No human judgment required.

Here’s what makes them powerful in real estate:

The Asset Vault

Custodies the legal representation of the property (often an NFT representing the SPV shares).

The Compliance Oracle

Before any token transfer occurs, this contract checks: Is the recipient verified? Are they an accredited investor? Are they in a sanctioned country?

If the answer to any of these is “no,” the transaction fails. Compliance by design, not compliance by hope.

The Dividend Distributor

Accepts stablecoin deposits (rent), snapshots the token holder list, executes batched transfers to all holders.

This requires serious gas optimization to work at scale, but when done right, it’s magical. Token holders see rent hit their wallets daily. Not quarterly. Not annually. Daily.

That psychological feedback loop is addictive. It turns real estate from a boring, illiquid investment into something that feels alive.

The Blockchain Technology Stack: What You Actually Need to Build

If you’re a technical founder or CTO reading this, here’s where the rubber meets the road.

Building a tokenization platform isn’t just slapping an ERC-20 token on a website. It’s a complex, multi-layered system that needs to handle identity, compliance, asset management, and real-time settlement—all while remaining secure and scalable.

Blockchain Infrastructure: Layer 1 vs Layer 2 vs AppChains Decision

Ethereum (Layer 1): The settlement layer of the internet. Maximum security and liquidity, but low throughput (15 transactions per second) and volatile gas fees. Good for high-value settlement, terrible for daily dividend distribution.

Polygon (Layer 2): The current industry standard. Inherits Ethereum’s security while offering 65,000 TPS and negligible transaction costs. This is where most serious platforms are built.

Solana: Extreme performance, gaining traction for high-frequency trading. But network stability concerns persist. For real estate, where asset security is paramount, the “move fast and break things” approach is risky.

Private/Permissioned Chains (Hyperledger/Corda): Favored by enterprise incumbents for privacy controls. But they lack the interoperability and liquidity of public chains.

The trend? Hybrid architectures. Sensitive data (PII, lease terms) lives on a private sidechain or secure database. The tokenized asset and settlement logic live on a public chain.

The Blockchain Backend: Where Most Platforms Fail

Here’s a dirty secret: the blockchain is the easy part.

The hard part? Building backend infrastructure that can handle massive data concurrency without falling over.

A platform managing 100 properties with 10,000 investors each generates enormous load:

- Listening to thousands of on-chain events

- Reconciling ledgers in real-time

- Updating user dashboards without latency

- Ensuring the “state” on the screen matches the “state” on the blockchain

Traditional web backends (Node.js, Python) often struggle with this concurrency.

This is where Iterators’ expertise in Scala and the Akka/Pekko toolkit becomes a strategic differentiator. Scala’s actor-based model is designed exactly for this type of distributed, high-throughput system.

It’s the difference between a platform that works smoothly at 100 users and one that scales to 100,000 without breaking a sweat.

The Mobile Experience: Making Blockchain Invisible

Users don’t care about blockchain. They care about seeing their balance, getting their dividends, and maybe voting on property decisions.

The mobile app—built on React Native—must abstract away all the complexity. Users should see “Balance: $5,000,” not “Wallet Connection Error: RPC endpoint failed.”

This is specialized work. You need developers who understand both cryptographic security and native mobile UX. It’s a rare combination, and it’s what separates professional platforms from MVP demos that never escape the sandbox.

Blockchain Regulatory Engineering: Code As Law (But Also Actual Law)

For executives, regulation is the primary risk vector. The mantra for 2025 is simple: Compliance First.

The days of “move fast and ignore the SEC” are over. Spectacularly over. Just ask the founders who got cease-and-desist letters.

The Securities Classification Reality

In the United States, almost all fractionalized real estate tokens are classified as securities under the Howey Test:

- Investment of money ✓

- In a common enterprise (the property) ✓

- With expectation of profit ✓

- Derived from the efforts of others (the property manager) ✓

This classification triggers strict requirements:

Regulation D (Rule 506c): The most common exemption. Allows unlimited capital raise but only from Accredited Investors. You must take “reasonable steps” to verify accreditation.

Regulation S: Allows sales to non-US investors. Often used with Reg D to tap global liquidity.

Regulation A+: The “Mini-IPO.” Allows sales to non-accredited (retail) investors. Requires lengthy SEC qualification and ongoing reporting, but it’s the holy grail for true democratization.

The European Advantage: MiCA

Europe has leaped ahead with MiCA regulation. It creates a unified licensing regime across the EU.

For founders, this regulatory clarity makes Europe highly attractive for establishing operations. No 50-state licensing nightmare. No regulatory uncertainty. Just clear rules.

ERC-3643: The Compliance Standard

To technically enforce regulations, the industry is adopting the ERC-3643 (T-Rex) token standard.

Unlike standard ERC-20 tokens (which anyone can transfer to anyone), ERC-3643 tokens have a built-in Validator.

Every transfer asks: “Is the receiver eligible?”

The Validator checks:

- Valid KYC flag?

- Not in a sanctioned country?

- Accredited investor (if required)?

If the answer is “No,” the transfer fails automatically.

This ensures tokens never leave the walled garden of compliant investors. It’s the difference between a platform that survives regulatory scrutiny and one that gets shut down.

The Blockchain Real Estate Landscape: Who’s Winning and Why

Understanding the current players reveals where opportunities lie.

Propy: The Transaction Layer Pioneer

Focus: Selling software to title companies and agents to move deals on-chain.

Strength: Deep industry integration and regulatory navigation.

Weakness: The “title company” focus can be slow to scale compared to direct-to-consumer models.

RealT: The Cash-Flow King

Focus: High-yield Section 8 housing in the US rust belt, sold to global investors.

Strength: Daily dividend payouts create an addictive feedback loop. Strong legal wrapper (Delaware Series LLC).

Weakness: Heavy reliance on specific US residential markets. Scaling to commercial assets requires a different approach.

Lofty.ai: The DAO Innovator

Focus: Building on Algorand, leveraging speed and low fees.

Strength: AI-driven property selection and active DAO community.

Weakness: Smaller developer ecosystem on Algorand compared to Ethereum.

The White Space Opportunities

The market is fragmented. Significant opportunities exist for:

The “Bloomberg of Tokenized Real Estate”: An aggregator pulling data from multiple platforms to provide a unified dashboard for investors.

Institutional Liquidity Pools: Building the “Uniswap for Real Estate” specifically for accredited/institutional investors.

Cross-Border Compliance Bridges: Infrastructure that automates tax and legal complexity for international investors.

This is where the real money is. Not in tokenizing individual properties, but in building the infrastructure that makes the entire ecosystem work.

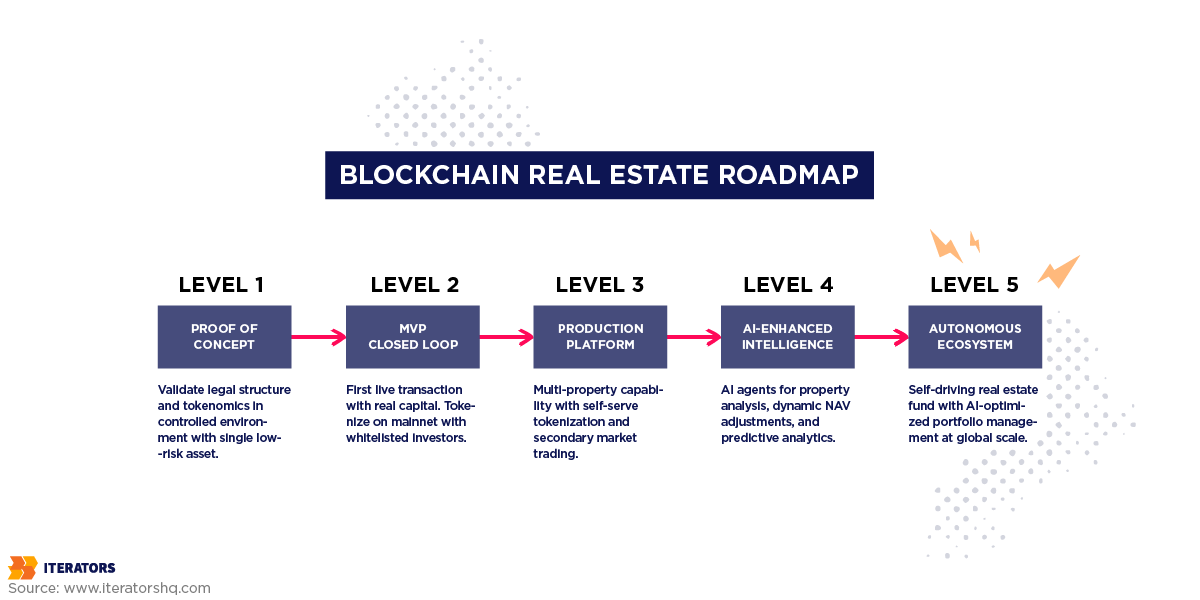

The Zero to Hero Implementation Roadmap

If you’re a startup founder looking to enter this space, here’s the phased deployment strategy we recommend at Iterators.

This approach minimizes initial capital expenditure while validating the riskiest assumptions (legal/regulatory) before scaling the technology.

Phase 1: Proof of Concept (The Regulatory Sandbox)

Objective: Validate legal structure and tokenomics without exposing capital to risk.

Action:

- Select single, low-risk asset (single-family rental)

- Entity formation (SPV)

- Draft Token Purchase Agreement

Tech Stack:

- Deploy basic ERC-3643 token on Testnet (Polygon Amoy)

- Build basic Investor Portal using React

- Smart contract unit testing

Deliverable: Legal opinion letter and working testnet prototype.

Phase 2: MVP (The Closed Loop)

Objective: Execute live transaction with real money and controlled investor group.

Action:

- Tokenize asset on Mainnet (Polygon)

- Whitelist small group of “Friends and Family” accredited investors

Tech Stack:

- Integrate KYC/AML provider (Sumsub)

- Implement stablecoin payment rail (Circle USDC)

- Deploy Dividend Distributor contract

Iterators Role:

- Secure backend deployment (Scala/Akka) to listen to chain events

- Real-time investor dashboard updates

- Mobile-responsive web app development

Deliverable: Successful fundraise and first automated rent distribution.

Phase 3: Production (The Platform Scale)

Objective: Open to broader markets and enable secondary trading.

Action:

- Generalize system to handle multiple properties

- Implement automated Factory Contract for self-serve tokenization

- Launch secondary market bulletin board

Tech Stack:

- High-load infrastructure

- Advanced data analytics (ETL pipelines)

- Integration with fiat on-ramps (Stripe/Plaid)

Iterators Role:

- Scale backend for thousands of concurrent users

- Security auditing and penetration testing

- State-of-the-art mobile apps (React Native) with biometric security

Deliverable: Fully functional, scalable tokenization marketplace generating recurring platform fees.

Phase 4: State-of-the-Art (The AI Ecosystem)

Objective: Competitive differentiation through intelligence.

Action:

- Integrate AI agents for property performance analysis

Learn more about the intersection of these technologies in our comprehensive guide to AI in blockchain.

- Dynamic NAV (Net Asset Value) adjustments in real-time

Tech Stack:

- Machine Learning models feeding Chainlink Oracles

- Generative AI for automated investor reporting

Iterators Role:

- Development of custom AI agents

- Integration of predictive analytics for property valuation

Deliverable: Self-driving real estate fund where AI optimizes portfolio and blockchain handles settlement.

The Real Risks (And How to Navigate Them)

Let’s be honest about the challenges. Because if anyone tells you blockchain real estate is easy, they’re either lying or selling something.

Blockchain Technical Risks

Smart Contract Bugs: A single error in your contract code can lock millions of dollars permanently. This isn’t theoretical—it’s happened multiple times in DeFi.

Solution: Comprehensive auditing by specialized firms (OpenZeppelin, Trail of Bits). Formal verification where possible. Bug bounty programs.

Blockchain Volatility: Even on stable Layer 2s, network congestion can spike gas fees unexpectedly.

Solution: Implement gas price oracles and transaction batching. Build in buffer periods for critical operations.

Regulatory Risks

Changing Rules: The regulatory landscape evolves constantly. What’s compliant today might not be tomorrow.

Solution: Build flexibility into your legal structure. Use modular smart contracts that can be upgraded. Maintain strong relationships with legal counsel who specialize in digital assets.

Jurisdictional Complexity: Different rules in different countries create compliance nightmares.

Solution: Start with clear jurisdictions (EU under MiCA, specific US states with clear guidance). Expand gradually.

Market Risks

Liquidity Illusion: Just because tokens can trade 24/7 doesn’t mean they will. Thin markets can create worse price discovery than traditional real estate.

Solution: Focus on creating genuine utility and value. Build community. Incentivize market makers.

Hype Cycles: The crypto market goes through boom-bust cycles that can affect sentiment regardless of fundamentals.

Solution: Build for the long term. Focus on real cash flows and real assets. Don’t get distracted by short-term price movements.

Why Iterators? (The Shameless Pitch)

Look, you’ve made it this far in the article. You clearly care about doing this right.

So let me be direct about why we think Iterators is the right partner for building blockchain real estate infrastructure.

We Don’t Just Write Code—We Architect Systems

Most development shops can build you a website. Great. But can they build a system that handles:

- Real-time settlement of thousands of transactions

- Complex compliance workflows across jurisdictions

- Secure key management for millions in digital assets

- Mobile experiences that make blockchain invisible

That requires specialized expertise. Scala for high-concurrency backends. React Native for native-quality mobile apps. Deep understanding of blockchain architecture.

We’ve built these systems before. We know where the bodies are buried.

We Understand The Business, Not Just The Tech

The biggest mistakes in blockchain projects come from developers who don’t understand the business model.

They build beautiful smart contracts that violate securities law. They create platforms that technically work but have no product-market fit.

At Iterators, our custom software development services have helped startups grow from idea to exit. We know how to ask the hard questions:

- Who actually wants this?

- How do you make money?

- What’s your regulatory strategy?

- What happens when you scale 100x?

We’re Partners, Not Just Vendors

We don’t take your spec, disappear for six months, and dump code on you.

We work iteratively. We challenge assumptions. We bring ideas to the table.

Because at the end of the day, your success is our success. We want to build things that actually ship and actually work.

The Final Word: Infrastructure Over Assets

Here’s the truth that most people miss about blockchain real estate:

The winners won’t be the people who tokenize the most properties. They’ll be the people who build the infrastructure that makes tokenization seamless, compliant, and scalable.

Think about the internet. The big winners weren’t the people who put up the first websites. They were the people who built the browsers, the search engines, the cloud infrastructure.

Same thing here.

We’re moving from an era of “trusting the brand” (the big bank, the established broker) to “trusting the math” (the cryptographic proof, the immutable ledger).

For founders and executives, the window to build the foundational infrastructure is open. But it won’t stay open forever.

The market is projected to grow 50x in the next decade. The technology is ready. The regulations are clarifying. The institutional capital is moving.

The question isn’t “if” real estate will move on-chain. The question is “who” will build the platform that takes it there.

Will it be you?

Ready to start building? Schedule a free consultation with Iterators. We’d be happy to walk you through the technical and strategic considerations for your specific use case.

Want to dive deeper? Check out our related articles: