If you have been on Twitter, Facebook, or any corner of the internet recently, chances are you must have come across “NFTs” at least once. These pixelated digital assets have generated a lot of sparking conversation around them, especially when some are priced at ridiculous valuations. For example, the “Nyan Cat” pop tart meme sold for 300 ether – approximately $600,000 – in February 2021.

This makes you wonder…” who would pay for a meme at such a high price?”. Keep in mind that this GIF of a rainbow-casting feline is just one of the ridiculously priced NFTs that have been auctioned over time.

Presently, there are over 30 NFTs that have sold for price points above $1 million. The interesting thing is, the NFT market is showing no signs of slowing down anytime soon. On the contrary, it keeps growing exponentially, with a 1700% increase in market cap as of March 2021.

The buzz and hype around NFT pose questions like if it’s overrated, a fad/bubble that will blow away soon, or if it is a good future investment. We will seek to answer these legitimate questions by diving into the depths and core foundation of what NFTs are all about.

Need help developing a custom blockchain solution? At Iterators, we design, build, and maintain custom software and apps for startups and enterprise businesses.

Schedule a free consultation with Iterators. We’re happy to help you find the right solution.

What are NFTs?

NFTs simply stands for “Non-Fungible Tokens.” Let’s break it down a bit by addressing the intricate term amongst these words – fungible.

An item is “fungible” when you can mutually exchange it for another item of a similar (if not equal) value. Take, for example, you and I both have five-dollar bills. If I give you mine and I collect yours, I have mutually replaced or exchanged the value of my item with yours.

This reciprocity is possible because the two items – the five-dollar bills in this case – are both similar (equal, really) in value. This same principle applies to cryptocurrencies like bitcoin. If I have a bitcoin, I can exchange it for another bitcoin. You would expect the opposite for a non-fungible item, as is the case with NFTs.

These tokens, unlike bitcoin and other cryptocurrencies, cannot be mutually interchanged with one another. This is because no two NFTs are identical in a sense. They may look similar, but their digital thumbprint is unique – just like in the case of identical twins.

Anything from a music clip, an animation, a digitalized work of art, or a concert ticket can be tokenized and linked to a corresponding digital signature known as an NFT. For example, in December 2019, Nike released cryptokicks, an NFT linked to a pair of physical Nike sneakers. It is given to you upon purchase, and it uniquely identifies you as the owner of the pair of kicks.

In a nutshell, an NFT is a digital stamp that verifies the ownership and authenticity of a digital or physical item it is linked to.

The current hype around NFT is mostly influenced by the digitalized visuals sold for ludicrous amounts of dollars. Making people believe NFTs are just Minecraft-looking GIFs or images, like cryptopunk, for example. But it can offer so much more than it is perceived to.

How Do NFTs Work?

There are forgery experts in the real world that can authenticate and tell if a piece of artwork is original or a duplicate. In the digital world, however, this has not been the case.

Music in mp3 format, pictures in jpeg, videos in 4k, and so on can all be duplicated by simply using the ancient art of copying and pasting/downloading. This made it difficult to tell who the original creator or owner of the digital asset is, and it also created an ecosystem of piracy…until recently.

In the digital world, the forgery experts are every single person or computer connected to the network on which the NFT is recorded. Now, what does this mean? Let’s examine the modus operandi of the blockchain – the framework on which the NFT is built.

The blockchain is a public digital ledger that tracks and records transactions in real-time. Because it is public, every computer connected to the blockchain network can verify the authenticity of digital assets by assigning them a digital signature. And on the blockchain, no two identical digital signatures can coexist.

As a result, any attempt to duplicate the asset will be rejected because its provenance cannot be verified. All this operation is facilitated by smart contracts embedded on the blockchain.

By tokenizing an asset, you are virtually assigning it a digital signature – an NFT – on the blockchain. Interestingly, it not only applies to digital content because physical assets can be tokenized too. It is a solution that cuts across the physical and digital world.

The technical term for making or creating an NFT is “minting.” Most NFTs are minted on the ethereum blockchain network, and the operation requires Web3-enabled wallets, like MetaMask, and some ETH coins. These ETH coins are used to pay for gas” for the operation to take place. You can read more on how to mint an NFT here.

This minting process gives the creator full autonomy to decide the scarcity of the asset and the royalties that will be accrued on each sale.

Characteristics of NFTs

The key attribute of an NFT is that it is non-fungible, which we have discussed in the preceding section. But there are other elements of an NFT that makes it a more powerful tool than we think it is.

- Authentic: NFTs record and store data on the blockchain, making it easier to verify and authenticate the asset’s original owner. So by nature, NFTs cannot be copied, substituted, or subdivided.

- Indestructible: All information stored on the blockchain cannot be erased simply because of how it operates. As a consequence, NFTs are indelible.

- Indivisible: You know how small-time investors like us can buy 0.0034 bitcoins, and it will still be worth something? You cannot do that with an NFT because they exist as a whole item. Think of it as digital signals of zeros and ones. You either have a zero (nothing) or a one (an NFT that is hopefully valuable). You can’t have anything in between.

What are NFTs Used For?

Currently, NFT fans are championing its revolutionary effect in the digital content industry. Digital artists and content creators can now make content without fears relating to piracy of unrecognition.

Also, NFTs make it easier for these content creators to monetize and actually get paid for their work. Though this revolutionary impact in content creation is the frontier for the advocacy of NFTs, it has other equally essential applications that will change the world as we know it today.

Here are some use cases for NFTs.

Gaming

The concept of buying in-game tokens, characters, vehicles, powerups, etc., has been around for as long as android games have been around. By introducing non-fungible tokens as in-app purchases, gamers will experience ownership like never before.

An early use case of NFT in gaming was Cryptokitties, a blockchain game that allows players to collect, purchase, breed, and sell virtual cats. It was a huge success, with the game recording over $1 million in total in-game transactions.

Cryptokitties did well to launch NFT gaming, and the interest keeps growing in the gaming community. In 2018, a Vietnamese video game developer – Sky Mavis studios – took NFT gaming to a whole new level with their NFT-based online video game called Axie Infinity.

The game has snowballed from just 10,000 users around the time of its release to averaging a total of 2 million players per month as of October 2021. This goes to show that gamers are generally accepting and getting accustomed to NFT-based gaming.

By and By, NFT is taking root in the gaming industry. Though it hasn’t enjoyed the rapid assimilation as it has seen in digital art, speculations are high, and gaming companies are thinking of a future where NFT gaming will be more of a reality.

Memorabilia

Besides digital art, NFT technology finds perfect use in the memorabilia and collectibles industry. One attribute of a collectible is that it is rare and unique. And most times, the dignity of its reality and uniqueness is related to its authenticity and verifiability – something the NFT technology can provide.

Since you can tokenize just about anything, sports memorabilia and collectibles, like baseball cards, can be NFTs. An NFT sports memorabilia will be much easier to authenticate and hard to counterfeit.

Music

One of the major future NFT projects will be in the music industry. Imagine a world where your favorite artists release their albums as NFTs, and you can have exclusive access to these albums by simply buying their NFT projects? It’s like getting a signed vinyl record.

From the artiste’s perspective, NFTs will provide ownership and control in unprecedented ways. For a long time coming, the music industry has been largely centralized. So much so that the top three record labels – Sony, Warner, and Universal – have a combined 68% market share in the music recording industry. And it is no news that record labels are fond of cheating musicians on the proceedings of their work.

Music artists such as Lil Wayne, Michael Jackson, Snoop Dogg, and the likes have complained about the sketchy contracts that tie them down with unfavorable conditions on several occasions. In addition, streaming services like Spotify and Apple music have added to the rot by denying musicians a fair share of the royalties on their projects. All that is about to change, with NFTs.

Just as bitcoin decentralized finance, NFT is set to decentralize the near-autonomous control music record labels and streaming services have on the projects of music artists. NFTs will provide a future where creators will have complete control over their work, and the fans will also have a significant role to play in it too.

Real-World Assets and Contracts

NFTs run on the blockchain, and a characteristic attribute of blockchain technology is that it provides verification and authentification of ownership. This attribute can be expressed through NFTs with real assets. For example, real estate deeds can be tokenized and assigned an NFT which will be used to verify the ownership of the property.

Contracts, intellectual property (IP), and patents can also be tokenized to cement their authenticity. NFT contracts will be immutable and transparent, leaving no room for any form of manipulation. The use case for patents and IPs will open a highly secure and profitable avenue for their commercialization.

Just like most NFT projects, tokenizing real-world assets and contracts are still in the works. But a future where assets, like houses, jewelry, or land, will be represented by NFTs on the blockchain is not too far ahead.

Fashion

Notable fashion brands like Gucci and Louis Vuitton have expressed their intentions to get into the NFT space as it will improve brand image and trust among customers. With the growing number of luxury fashion replicas in the market, top brands can protect their image by protecting their product’s authenticity using NFTs.

NFTs can also become a crucial tool in brand promotion as the IoT continues to develop. Fashion items and accessories can become collectibles in virtual games, which can then be used to redeem real items.

The Metaverse

With the new internet, dubbed Web 3.0, coming into realization faster than anticipated, NFTs are set to become a huge part of our lives. In the metaverse, we will be able to relate to the virtual environment with customizable avatars. And NFTs can offer a distinctive way of creating these avatars.

NFTs will find other use cases in the metaverse as both concepts intersect in so many ways. In his article, Shreyansh Singh, head of Polygon’s NFT and gaming arm, stated that NFTs would be the key to unlocking the metaverse. This is one of many statements where experts highlight the critical role NFTs will play in the metaverse. It suffices to say that NFTs will have an impact on how we adopt web 3.0, just as the dot com bubble did for the internet f today.

Examples of NFTs

If you type in the keyword “#NFTGiveaways” on Twitter, you will be bombarded with hundreds of tweets about different new NFT projects that come up every day. This goes to show the wide, rapid acceptance NFTs are gathering across the tech community. And the number of these projects keeps increasing by the minute.

Though a large percentage of these NFTs have no real value at the moment, some have made record sales over the last few months. We are going to focus on these NFTs examples in the following paragraphs.

Here are seven iconic NFT Examples.

Jack Dorsey’s First Tweet ( Sold for 2.9 million)

Twitter CEO and founder, Jack Dorsey, auctioned the first-ever tweet he made (and the first-ever on Twitter) for a final video offer of $2.9 million. The tweet made its debut on March 21, 2006, the same day Twitter was launched. The tweet was purchased by Malaysian businessman and Bridge Oracle CEO Sina Estavi on March 6, 2021, and was officially sold on the 22nd as there was no matching bid.

Here is the record of the auction.

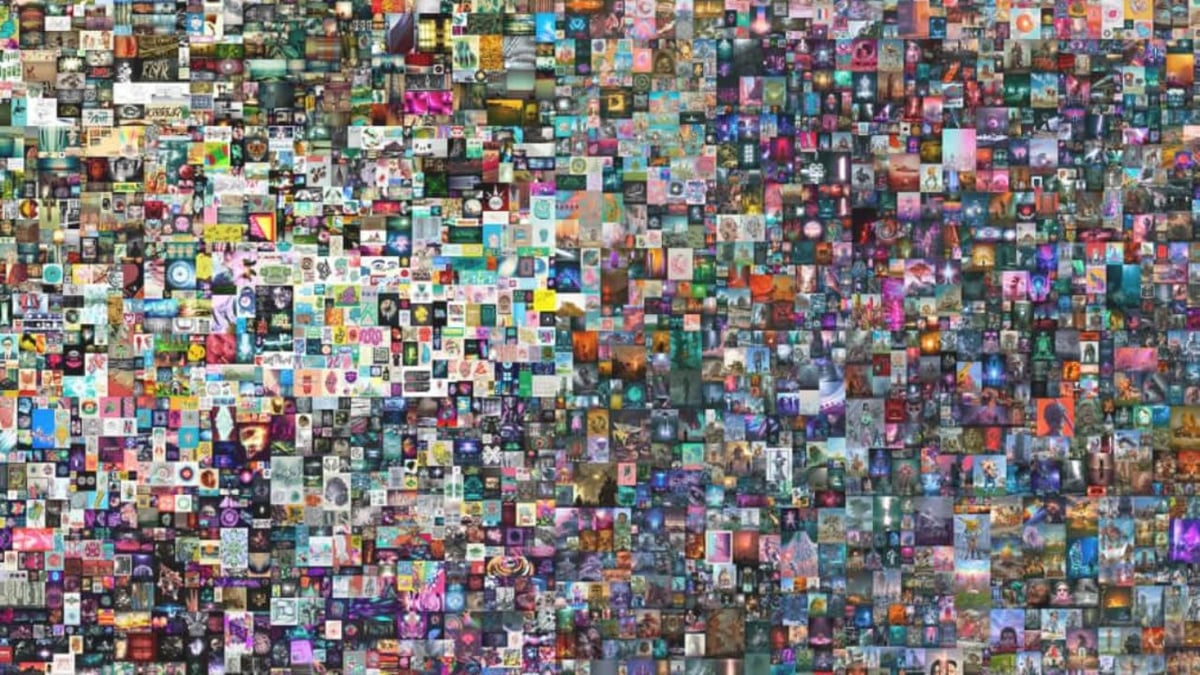

Beeple’s Everydays: The First 5000 Days (Sold for $69 million)

This is perhaps the most iconic NFT to date, selling at a world record high in NFT transactions. This digital art is valued at a similar price point as a Van Gogh or a Picasso.

This digital work of art was created by Mike Winkelmann (aka Beeple), and it is a collage that features 5000 digital images created by the artist for his “Everyday” series. Like every iconic piece of art, the first 5000 days has a story.

Beeple embarked on his Everyday journey on May 1, 2007, and every day, he would create a piece of digital art. All of which made up the digital mosaic that sold for over 42,000 ETH on March 11, 2021.

It was sold to a Singapore-based programmer, Vignesh Sundaresan, on Christie – a British Auction house.

Here is the record of the transaction

Grimes’ WarNymph Digital Collection 1 (total collection sales of $6 million)

Canadian musician, Grimes, is among the first in her industry to get into the NFT niche with her WarNymph collection.

This collection features ten pieces of digital art, each with different price points and rarity. There were some in the collection that had hundreds of copies, and some only had one copy. The most expensive piece in the collection – Death of old – sold for almost $400,000.

The entire collection was released on February 28 and auctioned off in under 20 minutes. This has to do with the tweet Grimes put up a few days before WarNymph was released.

https://niftygateway.com/collections/warnymphvolume1

Doge NFT (sold for$4 million)

You might be familiar with dogecoin, the satirical cryptocurrency named after the famous Shiba Inu dog, which featured in the legendary meme of 2010. This cryptocurrency has generated a lot of clouts and has got billionaires like Elon Must and Mark Cuban talking about it.

Earlier this year, the dog owner decided to ride on the popularity and already established community of dogecoin to create yet another ravey phenomenon in the Doge movement. He minted the original photo of the dog (Kabosu) as an NFT, which sold at a record-breaking price of $4 million- becoming the most expensive meme NFT ever sold.

The buyers, PleasrDAO, did something even more phenomenal with the Doge NFT after purchase. They decided to fractionalize the NFT into billions of ERC-20 tokens or “DOG tokens,” as they like to call it. Now anybody can own part of the Doge NFT with as little as a dollar.

Here is a link to the live fraction sale with the history of previous transactions recorded.

Conclusion

NFTs are essentially signatures used to prove ownership of digital assets in the digital world. The mere fact that any and everything can potentially be tokenized opens up a world of possibilities with NFTs.

The question remains, are NFTs the next big thing? Or are they just a craze like the ICO bubble of 2017? At this point, it is hard to say.

On one hand, NFTs provide solutions to digital ownership problems, and all the big companies like Nike are moving to this space. On the other hand, it is kind of hard to wrap your head around the concept of people paying millions of dollars for digital proof of ownership without any claim in the real world.

Only time will tell what the future holds for NFTs.